Living Allowance

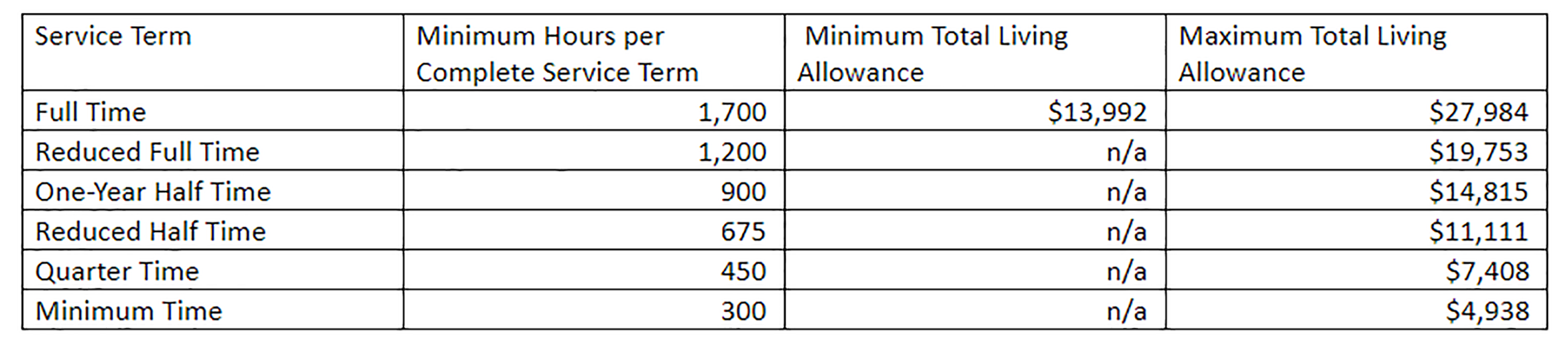

All full-time AmeriCorps members must be provided with a living allowance (member stipend). Though not required, programs have the option to provide an allowance to part-time members. All living allowances must be provided within the confines of the minimums and maximums provided in the table below.

Table 4: Member Living Allowance 2019-2020

AmeriCorps members are not employees and a living allowance is not a wage. Thus, living allowances are not distributed based upon the number of hours served during each pay period. Living allowances must be dispersed to members in equal amounts throughout their term of service. Deductions should be made for federal and state income taxes, where applicable, and FICA (Social Security and Medicare taxes). The pay periods for living allowances are determined by each program. So long as a member is enrolled and has in-service status (see Member Status), they must receive their living allowance listed in their member contract in equal increments throughout the program year. If a member is released early for any circumstance (including a personal and compelling circumstance) they may not receive a lump sum of the remaining balance of their living allowance.

To document and verify that members are completing their service hours, accurate timesheets that are properly signed and approved must be processed for each pay period (see Management Plan). Timesheets are to be maintained in a safe and secure location (physical or electronic) in accordance with applicable AmeriCorps regulations.

Federal Benefit Eligibility

The National and Community Service Act of 1990 provides that allowances, earnings, and payments to participants in AmeriCorps State and National programs “shall not be considered income for the purposes of determining eligibility for and the amount of income transfer and in-kind aid furnished under any federal or federally-assisted program based on need, other than as provided under the Social Security Act (SSA).” Additionally, under the Heroes Earnings and Relief Tax (HEART) Act of 2008, the Social Security Administration will ignore an individual’s receipt of AmeriCorps benefits for purposes of Social Security Insurance (SSI) eligibility. The Heart Act excludes “any benefit (whether cash or in-kind)” and so covers the living allowance, health insurance, child care and the education award (and related interest payments).

Note: If your members will be provided a living allowance while receiving/applying for Temporary Assistance for Needy Families (TANF), federal work-study, or SSI benefits, they may be impacted by the above statements. Program Directors should consult the AmeriCorps*State and National Management Guidance provided by CNCS at http://www.nationalservice.gov/build-your-capacity/grants/managing-americorps-grants ) and/or contact their CCCS Program Officer with any questions.

Health Care

Programs[1] must provide, or make available, healthcare insurance to those members serving a 1700-hour full-time term who are not otherwise covered by a healthcare policy at the time the member begins his/her term of service. Programs must also provide, or make available, healthcare insurance to members serving a 1700-hour full-time term who lose coverage during their term of service as a result of service or through no deliberate act of their own. CNCS will not cover healthcare costs for dependent coverage.

Less-than-full-time members who are serving in a full-time capacity for a sustained period of time (e.g. a full-time summer project) are eligible for healthcare benefits. Programs may provide health insurance to less-than-full-time members serving in a full-time capacity, but they are not required to do so. For purposes of this provision, a member is serving in a full-time capacity when his/her regular term of service will involve performing service on a normal full-time schedule for a period of six weeks or more. A member may be serving in a full-time capacity without regard to whether his/her agreed term of service will result in a full-time Segal AmeriCorps Education Award.

Any of the following health insurance options will satisfy the requirement for health insurance for full-time AmeriCorps members (or less than full-time members serving in a full-time capacity): staying on parents’ or spouse plan; insurance obtained through the Federal Health Insurance Marketplace of at least the Bronze level plan; insurance obtained through private insurance broker; Medicaid, Medicare or military benefits. AmeriCorps programs purchasing their own health insurance for members must ensure plans are minimum essential coverage (MEC) and meet the requirements of the Affordable Care Act.

On Friday May 2, 2014 the U.S. Department of Health and Human Services (HHS) announced a Special Enrollment Period (SEP) for members in AmeriCorps State and National programs, who are not provided health insurance options or who are provided short-term limited-duration coverage or self-funded coverage not considered MEC. Members in the AmeriCorps State and National programs and their dependents in the Federally-facilitated Marketplace (FFM) are eligible to enroll in Marketplace coverage when they experience the following triggering events:

- On the date they begin their service terms; and

- On the date they lose any coverage offered through their program after their service term ends. (Source: 45 CFR § 155.420(d)(9)).

Members have 60 days from the triggering event to select a plan. Coverage effective date is prospective based on the date of plan selection. A copy of the HHS Notice, which provides instructions on how to activate the special enrollment period, is available at https://www.cms.gov/CCIIO/Resources/Regulations-and-Guidance/Downloads/SEP-and-hardship-FAQ-5-1-2014.pdf. Members can also visit healthcare.gov for additional information about special enrollment periods: https://www.healthcare.gov/coverage-outside-open-enrollment/special-enrollment-period/.

If coverage is being provided via the Healthcare Marketplace, and thus third party payment is not an option, programs must develop a process to reimburse members for monthly premiums. Reimbursements for health insurance premiums are considered taxable income for the member, and programs must have a way to document such reimbursements.

Additional guidance is provided by CNCS in AmeriCorps State & National Member Health Care FAQs: http://www.nationalservice.gov/sites/default/files/page/AmeriCorps_Health_Care_FAQs_5_12_2014.pdf

[1] Except for EAPs, Professional Corps, Partnership Challenge awards, or members covered under a collective bargaining agreement.

Medicaid and Medicare

Health care coverage must also be provided to full-time members who are eligible for Medicaid or Medicare. Medicaid and Medicare are considered wrap-around coverage, which means that these systems will pick up any costs that the health insurance policy provided by the member’s AmeriCorps program does not cover. The U.S. Department of Health and Human Services (HHS) has taken the position that members receiving Medicaid must have coverage available to them through AmeriCorps.

Childcare

Childcare must be made available to AmeriCorps members who meet all of the following criteria:

- Must be an active full-time (or full-time capacity) member of AmeriCorps who is not serving in a Professional Corps program.

- Member must need child care services in order to participate in the AmeriCorps program.

- Member’s household income must not exceed the maximum amount under the Child Care & Development Fund (CCDF) Block Grant rules established by the state or territory in which the child care services are provided.

- The member must be a custodial parent or legal guardian of a child under the age of 13.

- The child must be living with the member.

- Once the member is approved and accepts AmeriCorps Child Care Benefit Program (CCBP) benefits, the member must not be receiving a child care benefit for the same child from any other source.

These requirements and the Child Care application are available at https://www.americorpschildcare.com/; programs should maintain a copy of the member’s completed CCBP application in the member’s file.

It is the Program Director’s responsibility to inform the CNCS-designated AmeriCorps CCBP provider (currently, GAP Solutions Inc. — contact information is available at the link provided above) of a member’s eligibility for child care services. In addition, Program Directors must inform the CCBP provider in writing if:

- A member becomes eligible for childcare

- There is a change in a member’s eligibility status

- A member wishes to change childcare providers

- A member receiving childcare is absent for 5 or more days in a one month period

If programs fail to immediately notify the CNCS-designated AmeriCorps CCBP provider, costs incurred may be charged to the program.

Eli Segal Education Award

Members are eligible upon successful completion of their terms of service to receive an Eli Segal Education Award. The amount of the Award received is aligned with the member’s minimum service hours. Current award amounts are available at the following link. Members have up to seven years after the completion of service to make use of the Award. The Award is considered taxable income in the year that it is used.

Note: Program Directors should see http://www.nationalservice.gov/programs/americorps/segal-americorps-education-award for topics that should be covered while speaking with or training members about the Education Award.

Education Award Transfer

Members aged 55 and over have the option to transfer their Education Award to a child, grandchild, or foster child. For a tutorial to share with members, visit the link provided above.

Loan Forbearance and Interest Accrual

Enrolled AmeriCorps members are also eligible for forbearance and interest accrual payment for most federally-guaranteed student loans. Applying for forbearance gives members the opportunity to postpone repayment for qualified student loans. While in forbearance, interest will continue to accrue. However, if the member successfully completes his/her term of service, the National Service Trust will pay all or a portion of the accrued interest. The interest accrual payment is considered taxable income in the year that it is provided to the member. To gain access to the necessary forms members must create their own My AmeriCorps account. Further details are available at: http://www.nationalservice.gov/programs/americorps/segal-americorps-education-award/using-your-segal-education-award/postponing

-

IMPORTANT!: Per your Grantee Contract and the Terms & Conditions for AmeriCorps State & National Grants, your organization is responsible for ensuring adequate general liability coverage for the organization, employees, and members, including coverage of members engaged in on- and off-site project activities.